Stock Ticker: Sony

Japan's markets have lost patience with Sony's restructuring. Is a tighter focus on PlayStation the only way forward?

What we used to call a "rough few years" for Sony is rapidly on its way to becoming a rough decade - and it's only getting rougher. Last week's financial reports were nothing short of absolutely dreadful - the small loss (¥1.6 billion) is nothing to cheer about, but is overshadowed by the much more worrying decline in sales, which dropped nearly 10 per cent to ¥1.5 trillion.

Forecasts imply that that 10 per cent drop in sales is unlikely to recover in the near future, while profits are expected to continue to languish down around the break-even point. It's not quite catastrophic stuff, at first glance - the company isn't haemorrhaging cash, at least - but when you consider that this is meant to be the tail end of CEO Sir Howard Stringer's far-reaching reforms to get Sony back on track, suddenly everything looks rather bleak.

The problem with assessing Sony, of course, is that what we're really interested in is only one division of the company - the PlayStation business. Dividing that business off from the rest of the company is tricky, especially when it comes to stock market movements, and it's especially difficult now that the PlayStation business is bundled with the LCD television business as part of the Consumer Products and Services division.

The past 12 months have been the worst year for Sony since the 2008 financial crisis

As such, the overall fortunes of Sony as a company don't directly reflect the fortunes of PlayStation. The price cut to the PS3 back in August may have had some marginal impact on the company's figures this quarter, certainly, but overall the PlayStation business is a bright spot - consoles sales of both PS3 and PSP were up (the latter somewhat surprisingly, given the imminent launch of PS Vita), while PS3 software sales also rose.

Yet even though it's important to bear in mind that the PlayStation business is right now stronger than it's been at any point since the launch of PS3, it's also informative to look at Sony Corporation in wider focus - because after all, the health of the company as a whole has a huge impact on the muscle which it can bring to bear on the games industry and the home entertainment sector as a whole.

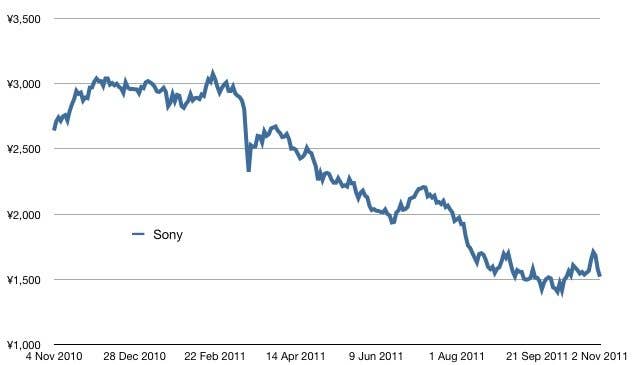

The health of the company as a whole, from the perspective of the markets, is sadly not very good at all. Here's the graph for the past year:

This steady drop in share price - punctuated by the familiar heavy dip following the Great Tohoku Earthquake in March - actually makes the past 12 months into the worst year for Sony since the 2008 financial crisis. There are a number of possible explanations for the weakness, but the most convincing is simply this - that the markets have lost faith in the direction Sir Howard has brought the company, and no longer believes that his reforms are going to bring Sony back from the tough position in which it's found itself.

Yet there are other explanations, some of which deserve consideration. Most notably, Sony is a business that's immensely focused on exports. Although it does have a significant domestic Japanese market share, for the most part it's still structured like many other businesses from the post-war decades in Japan - its fortunes rising or falling depending on its ability to achieve success in export markets.

The markets have lost faith in the direction Sir Howard has brought the company, and no longer believe in his reforms

As such, three key events this year have had a potential bearing on Sony's stock price - firstly, the historic highs of the Yen on the international markets, which have been so catastrophic for export-led businesses that the usually placid Bank of Japan has been forced to step in on multiple occasions to attempt to slow the appreciation of the currency. Second and third are a pair of natural disasters; the Touhoku earthquake, of course, caused supply chain problems for many manufacturers, but less obviously, the ongoing flooding in Thailand has also submerged many factories involved in supplying high-tech businesses under metres of muddy water. Sony, Nikon and Honda are among the worst-affected of a host of tech businesses facing knock-on difficulties from this.

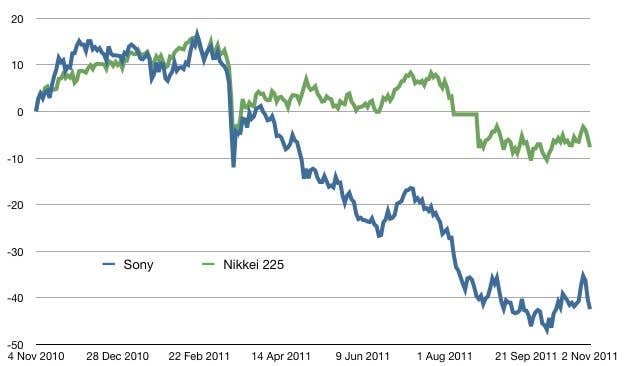

It's worth looking, therefore, at Sony's performance relative to the rest of the Tokyo Stock Exchange - after all, thanks to a combination of the above factors, this hasn't exactly been a stellar year for Japanese stocks in general. Sony itself attributes its poor performance to the Thai floods and currency difficulties, so we'd expect to see that other Japanese companies (many of the largest of which are equally export-led) are experiencing similar problems and dragging the Nikkei 225 index down with them.

Or, perhaps not. In fact, this graph is somewhat kind to Sony, since measuring from exactly 12 months ago gives us a starting point where the Nikkei was high and Sony somewhat low, so their relative change figures actually look a bit better for Sony than a longer-term graph would suggest. However, the 12 month sample still paints the picture pretty well. Sony tracks the Nikkei up until the earthquake, but where the Nikkei continues on a reasonably even keel after mid-March, Sony drops off heavily and continues to do so right up to the present point.