Stock Ticker: Sony

Japan's markets have lost patience with Sony's restructuring. Is a tighter focus on PlayStation the only way forward?

Just about every company in Japan is taking a battering from the exchange rate, and a huge number of large export-led companies have been afflicted by the Touhoku Earthquake, the subsequent power shortage concerns across eastern and north-eastern Japan, and most recently the Thai flooding. It's arguable that Sony has more exposure than most to some of these problems, especially the Thai flooding, but the reality is that the malaise in Sony's share price dates to well before the Thai floods. There's a much deeper problem in how the markets perceive Sony right now. I'd argue that the original argument stands; Japan's markets have lost confidence in the ability of Sony's management to turn the company around.

That brings us neatly to the next graph, which is likely to raise eyebrows among followers of the games business. Sony is a company which, in my view, has no clear forward strategy and lacks the confidence of the markets in its ability to restructure itself into a growing, profitable business - yet thanks to its global span, brand recognition and massive inertia, continues to enjoy fairly large (albeit declining) quarterly sales. In these factors, it's arguably not dissimilar to Nintendo, another firm whose large sales base belies the uncertainty over its ability to remain relevant in a rapidly transitioning market.

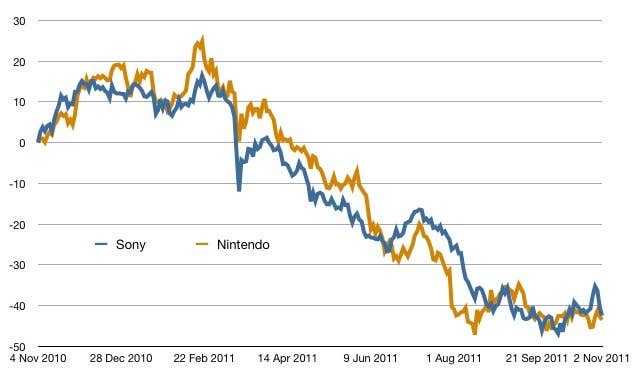

It would appear that traders on the Japanese markets agree with the assessment which equates the struggles of these two companies, because their graphs mirror one another to an almost eerie degree.

In fact, over the past year, the two companies have lost almost exactly the same proportion of their share price value, and have done so in almost precisely the same pattern. Despite the huge diversity of Sony's business by comparison with Nintendo's tight focus on games, the reality is that from a market perspective, they're both just consumer electronics firms - and as such, they're both open to exactly the same challenges and stricken by exactly the same difficulties, such as exchange rate and uncertain forward strategies.

Yet from our point of view in the games business, it's important to refer back to the focus on the PlayStation business specifically. The reality is that while Nintendo and Sony face similar problems, there's a sharp contrast between Nintendo and PlayStation. The PlayStation business has had a tough few years, but it's presently growing fairly well, and there's strong excitement around PlayStation Vita - as well as the beginnings of an intelligent mobile strategy through the firm's PlayStation Suite initiative.

The reality is that what's dragging Sony down isn't the PlayStation business - it's almost everything else, and especially the LCD TV business, which is frankly nothing less than a costly, idiotic millstone around the company's neck. The worrying reality is that after half a decade or more of cuts and restructuring which were strongly implied to be so painful as to be well outside the company's comfort zone, Sony is still treating businesses which are a pointless waste of time and money as core business units - allowing its figures to be dragged down, quarter after quarter, by either blindness or inertia which prevents the firm from getting out of market sectors which will never be profitable again.

What's dragging Sony down isn't the PlayStation business - it's almost everything else, and especially the LCD TV business, which is frankly nothing less than a costly, idiotic millstone around the company's neck

The LCD TV business is absolutely emblematic of the rot at the heart of Sony's strategy. It's an area in which the company has an incredible track record and history, but that history is blinding Sony to the modern reality - that LCD TVs have become a cheap commodity product, easily and cheaply manufactured in South Korea, China or in emerging markets like Vietnam and Thailand.

Even if Sony moves its own manufacturing to those locations - as it has done in many cases - it's still faced with the overheads incurred simply by being a Japanese company, and it faces rivals which receive massive subsidies and backing from their national governments, either overtly or covertly. In private, Sony's most senior executives express anger at seeing their latest TV models being undercut over and over again by manufacturers like Samsung, a strategy which they believe is encouraged and funded by the South Korean government - yet the obvious logical step to a recognition that the LCD TV market is no longer a worthwhile business for a firm like Sony has never been made.

(I had hoped to include a comparison graph of Sony and Samsung's share prices here, but unfortunately, historical data from the Seoul stock market is not available to me in a usable form. Suffice it to say that despite the dip caused by its legal battles with Apple - which the markets quite rightly expect it to lose - the South Korean firm's shares are up around 25% for the past 12 months, compared to the 45% loss in value for Sony.)