How games audiences have changed post-pandemic and how to reach them

Tim Lion, Meta's EMEA head of gaming marketing, reveals research into how gamers are playing post-pandemic and offers insights for a new era of advertising

Last year we reported on the explosive growth of new players who joined the games universe. Shelter-in-place measures brought on by the COVID-19 pandemic meant the industry met an influx of new players and reengaged lapsed players. The result was the biggest global gaming audience in the industry's history -- never before had so many people been playing, watching and streaming, a tale-tale sign that people found much-needed camaraderie and entertainment in gaming.

Fast-forward to 2022, and we find that this growth has sustained itself. Not only is this evidence of the industry's ascent but it, of course, presents games companies with exciting opportunities to acquire new fans and evolve as the landscape does. But thriving in such an active environment requires several approaches and the first is consideration for who your potential fans are and how their behaviours have evolved. In light of this, our Games Marketing Insights for 2022 report delivers refreshed research on player trends and motivations across four major markets -- the UK, US, South Korea and Germany. The report is available to download for free today.

A snapshot of what's inside

In the first part of our report, The Evolving Gaming Landscape, we provide refreshed research on the behavioral trends of 'new gamers' -- those who began playing in 2019, and 'established gamers' -- those who were playing before the pandemic. We consider areas such as age difference, hours spent playing, the importance of collaborative gaming and more. Our latest results portray an audience that continues to differ from the pre-pandemic era and in many ways, they give an indication of how the landscape is moving forward. Here's a glimpse of what we know about them:

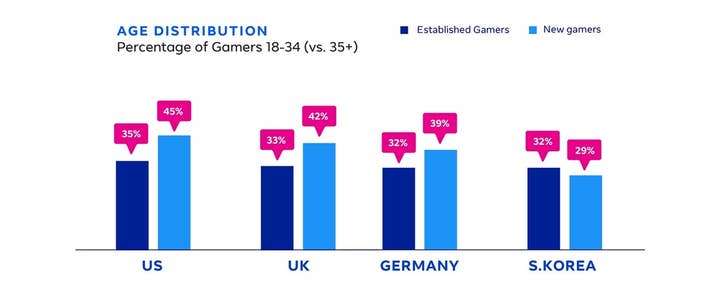

Age distribution

The majority of new gamers remain younger than established gamers. But in South Korea, more established players fall into the younger cohort than new players.

Playing time, expenditure and motivations

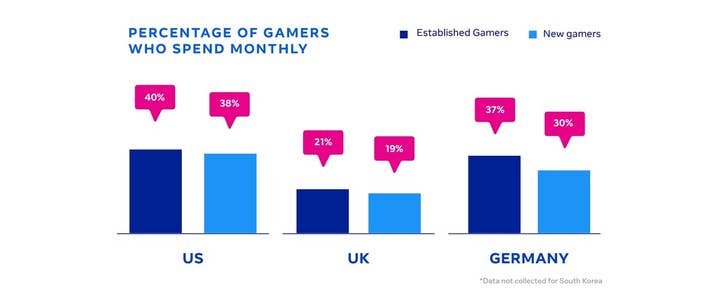

In contrast to our 2021 insights, research indicates that new gamers spend less time playing per week than established gamers. Taking the US as an example, only 15% of new gamers report playing more than 11 hours per week compared to 33% of established gamers.

Further, established gamers in the US, the UK and Germany don't just play more, they also spend more on games. For example, 40% of US players share an average spend of $26.38 --this is a shift from what survey respondents indicated at the height of the pandemic.

However, there is consistency in other key areas: both cohorts across all markets prefer free-to-play, ad-supported games above any other monetization model.

Other key considerations

As trends evolve and the gaming universe expands, delivering a holistic gaming experience requires new consideration for an audience that is compelled by collaborative gaming. In particular, live streaming and Gaming Groups are seeing increased engagement, with streaming time on platforms Twitch and Facebook Gaming reaching new highs in Q2 2021. The advancement and accessibility of AR and VR has encouraged more engagement and Cloud technology continues to soar. This is particularly true in the UK and the US, where year-on-year the percentage of streaming time increased from 10-15% and 10-18% respectively.

Diversity in gaming

This growing global gaming audience is incredibly nuanced, offering significant opportunities for all marketers. With that in mind, it's time to ask questions about who comprises this audience -- What reflects their lived experience for example? What do they want to see from games advertising? To answer questions such as these, later in the report we take a deeper look at diversity in gaming. We put particular focus on underrepresented groups, such as, the LGBTQ+ community, women and people who identify as non-binary, and we consider what it means to be inclusive in games and advertising.

Building valuable connections

The industry is booming but it's also in the midst of change -- privacy regulations and operating system updates have, in essence, brought the games industry kicking and screaming into a new era of advertising. Tried and tested UA and measurement practices have been impacted and now, games companies must reimagine performance marketing strategies to connect with players. This is one of the most pertinent issues the mobile games industry currently faces: how can games companies drive marketing performance in a landscape of potential players, when usual marketing practices are no longer wholly effective? We consider this in our Games Marketing Insights for 2022 report, and offer our hypothesis for a new organizational structure that aims to build meaningful relationships with players as the basis of user acquisition.

Get your free copy of the report

To learn more about a growing and diverse audience and to prepare your business for a new era of games advertising, download Games Marketing Insights for 2022 for free now.