Why it's become harder to raise investments in mobile game development in 2024

Azur Games co-founder Dmitry Yaminsky looks at the costs breakdown of making hypercasual and casual mobile games

Sign up for the GI Daily here to get the biggest news straight to your inbox

During the pandemic, the margins in the mobile games market continued to grow, surpassing expectations. Even after the initial surge, the market remained attractive despite a slight decline in growth, enabling high margins or significant returns when selling a share.

However, the current situation is more nuanced. Game development professionals often regarded other business niches with disdain, citing superior financial metrics as the reason.

And now, everything has changed.

Without resorting to the usual doomsaying about the hypercasual market, it still represents a massive portion of global installs, accounting for 26% of all mobile games in 2023. A few years ago, almost every project had the potential to soar. But currently, out of a thousand new games, there might not be a single hit.

The majority of installs continue to cluster around older projects, which publishers have developed and supported for years using a model akin to games-as-a-service. Yes, working in this market is both possible and necessary (our corporate group alone garnered more than two billion installs last year), but it's also essential to realistically assess the profitability of this sector.

The casual market has witnessed a similar shift. Previously, it was feasible to secure funding for a prototype without any metrics, primarily because the success rate among such projects was about one in 10-15. Nowadays, it's rare for companies to invest in projects without preliminary metrics. Exceptions exist for teams with an impressive background, but this doesn't mitigate the extremely high competition in the market. This all implies that it's nearly impossible for a small, young team to launch a successful project. There are success stories in the market, but focusing on them would be to fall for the classic survivor bias. Market growth has slowed, advertising effectiveness has decreased, and margins have normalized.

To develop a successful casual project now, it's crucial to invest in a team of several dozen people, acknowledging that several attempts might be necessary before releasing a project ready for scaling.

Let's take a closer look at how the business has changed over the past few years in terms of costs and profitability, examining both the hypercasual direction and the business models for casual and midcore, which have now become one of our priorities for further development.

What has changed

Three to five years ago, hypercasual games were at their zenith, often developed by just one or two individuals. A single core mechanic, coupled with relatively straightforward visuals, was sufficient to catapult a game to the top, achieving margins exceeding 50% after considering revenue sharing. At that time, little to no emphasis was placed on effects, production quality, details, UI, etc.

This scenario sparked a massive influx of developers who became trailblazers in this genre and managed to carve out successful business ventures with relatively modest investments. An expenditure of $2,000 to $5,000 — largely underwritten by publishers — offered a one in 20 shot at launching a project that could not only recoup the initial outlay but also generate revenues in the hundreds of thousands of dollars per month.

Fast forward to 2023/ 2024, and the typical team composition for hypercasual game development looks something like this:

- One or two developers

- A game designer

- An art manager

- A VFX specialist

This setup represents the bare minimum required to work on just one prototype, and in some instances, a hypercasual team can expand to as many as ten members. Given that out of 20 projects, there may not be a single one that succeeds or breaks even, studios are compelled to scale up the number of such teams, which in turn dilutes profitability.

It's common to find studios operating three to four teams concurrently, each developing multiple projects while adhering to stringent quality standards. Studios readily bring on board modelers, artists, and level designers for specialized roles. Merely having a compelling mechanic is no longer enough; it's crucial to immediately refine the core gameplay's presentation, fine-tune monetization strategies, structure level progression, and enhance effects and animations.

Moreover, many publishers also deploy their experts to assist partner studios, including producers, game designers, marketers, analysts, sound designers, app store optimisation specialists, and more.

Consequently, the average development cost for a project that demonstrates promising metrics, accounting for all iterations, can easily surpass $20,000. This figure needs to be multiplied by the number of attempts to launch the next big hit, mirroring a typical VC scenario where only one among dozens of projects achieves breakout success.

Profitability and costs

Let's delve into the most intriguing aspect: the current average margin for hypercasual projects hovers around 10% to 15%. Typically, a team might comprise:

- One or two developers

- A game designer

- An art manager

- A VFX specialist

- Possibly studio heads

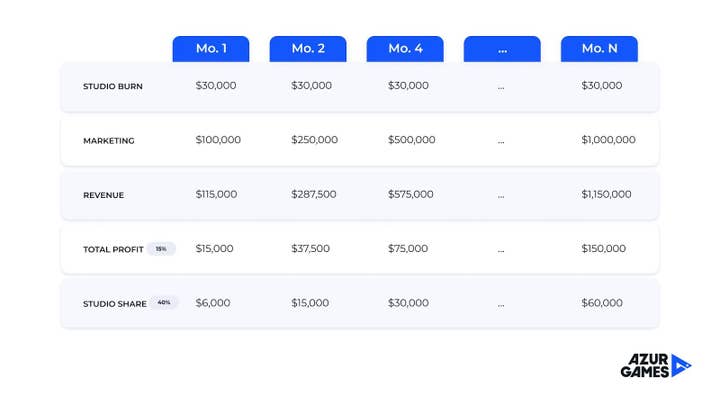

Factoring in salaries and additional expenses, sustaining such a team can cost around $30,000 per month. It's crucial to note that operating without a publisher significantly escalates costs, necessitating hires like marketers and lawyers, though we'll set aside this scenario for now.

To break even with such a team, you'd need:

- A project that can sustain a marketing spend of $500,000 per month or more, achieving at least a 15% margin

- Continuous reinvestment to either boost or maintain current revenue

- Further investment into new projects to fuel growth

Remember, initial investments are also deducted from the revenue share until net profit zeroes out– only then can actual profits be discussed.

This paints a less rosy picture of entrepreneurship, doesn't it? Essentially, this venture is not as lucrative as it seems, paralleling traditional offline businesses. On average, investments in this sector recoup in about 18 months to two years, eventually yielding market-standard profits.

Developing a game in the hypercasual genre now takes between two to four months, requiring salary payments throughout. Even with a successful launch and user acquisition underway, it's unlikely that you can expect to spend $500,000 on marketing right off the bat; it's more likely that the spending needs to be incrementally increased.

In summary, for a team with a $30,000 monthly burn after a few months of development and launching a successful product at a 15% margin, the financial breakdown (assuming the typical 40:60 hypercasual revenue share ratio) looks something like this:

Thus, breaking even immediately is unrealistic, and there's a high chance initial months spent on prototype development might go to waste. Most likely, starting from scratch several times might be necessary before hitting upon a successful formula.

Casual and midcore

When we shift our focus to casual and midcore games, the financial landscape becomes even more intriguing, largely hinging on the specific project. The key figure for investors is the average success rate of these projects. Statistically, one out of every ten projects hits the mark, ensuring a return on investment for the other nine within a two to three year span.

Investment costs for developing a single casual project start at around $500,000 initially and can balloon to $2 million to $3 million if the project makes it to launch. There's always a point where it might become evident that the game hasn't found its market fit, effectively zeroing the invested capital.

Let's break down the crucial stages in casual/midcore development, assuming collaboration with a publisher:

- Start with a core team of 15-20 people

- Within a year, develop the game's initial prototype

- Gather basic performance metrics to decide whether to proceed

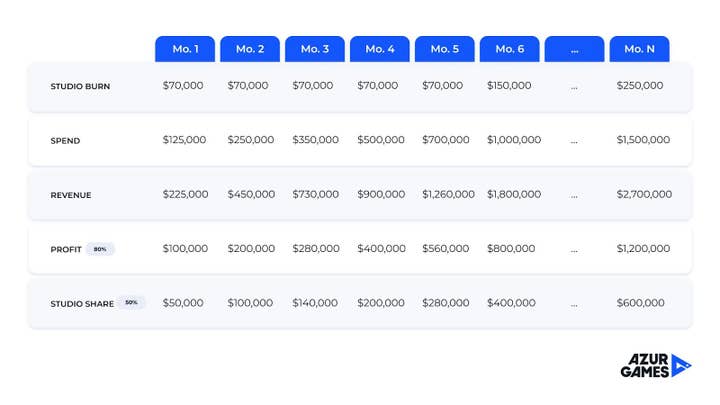

- If metrics are promising, scale the team for comprehensive development, which increases the studio's monthly expenses to at least $70,000

- Spend up to two additional years refining the game before its full release

That is, the profitability of a successful casual/midcore project should offset an average of $10million to 15 million in unsuccessful investments. Naturally, the success rate may vary, but this gives a general overview of the market.

It's also crucial to understand that investments in such projects grow incrementally. Therefore, for a while, even with investments exceeding $300,000, the company might break even, channeling all revenues back into further development and the broadening of marketing efforts.

Now, let’s crunch the numbers for a casual/midcore project, considering a studio with a $70,000 monthly burn rate over a few years leading up to a successful launch. Let’s assume a profitability margin of 80%, factoring in a significant contribution from organic traffic which can be as high as 30% in casual/midcore. Also, negative profitability is not uncommon for this kind of project during year one, so this is either a very optimistic scenario or something that would ring more true for the second year of operation in real life.

With the studio’s revenue share at 50%, the financial breakdown could look like this:

Midcore projects present another intriguing aspect. The last columns show a rising trend in the team's operational costs. While the specific figures can vary, the underlying principle remains consistent: teams must scale progressively in line with expenditure. Occasionally, it's necessary to increase spending to support growth, which might necessitate the onboarding of more specialists. However, hastily assembling a large team from the outset isn't practical; it's cost-prohibitive and significantly elevates the risk of project termination.

Perhaps it's time to think about diversifying?

Mobile game development, much like the broader tech industry, has ceased to be the gold rush it once was, where you could easily jump in and hit the jackpot in a growing market. Nowadays, it's not just about chasing high margins; it's about navigating a mature industry where serious contenders with comprehensive strategies and deep expertise thrive, while smaller companies face significant challenges. And to work in it, it's not just about being able to develop games but also about genuinely loving what you do.

So why has the process of securing investment rounds become more challenging? Investors are primarily concerned about return on investment, as global objectives remain constant. Consequently, the volume of investments and deals involving major players has notably declined in recent years.

Game studio founders must understand that their projects need to generate profits comparable to those of other industries. While offline businesses might not seem as trendy to tech enthusiasts, they often offer higher margins.

Consider, for instance, the restaurant business. Opening a restaurant in the UAE, where taxes are simpler, offers a clear picture. The initial investment for a high-end restaurant could range from $3 million to $6 million, with a payback period of two to four years.

A typical revenue distribution breakdown might look like this: 25% for food costs, 25% for staff wages, 25% for rent, and 25% as pure profit. This distribution is averaged due to the highly seasonal nature of this business.

With a typical monthly revenue of $500,000, the breakdown would be:

- Food:$125,000

- Staff: $100,000

- Premises: $150,000

- Pure profit: $125,000

Comparatively, the chance of profitability in the food service industry is often higher than in game development, even though scalability may not be as extensive.

In mobile game development, project profitability has declined on average, with successful launches becoming increasingly rare. Fledgling teams without significant expertise face uphill battles, while larger players must adjust their expectations and focus on sustainable, quality products.

Product quality and long-term sustainability now take precedence. Sometimes, developers find themselves torn between pursuing their dream game and managing the business side effectively. In such cases, seeking guidance from a strategist who can provide infrastructure and targeted business assistance can be beneficial.

Ultimately, everyone has to make their own decisions. But it's essential to remember that the market operates on financial logic, making economic considerations paramount in any investment decision. This leads to the industry comprising companies that not only have game development skills but also understand and handle all the necessary business aspects.

Sign up for the GI Daily here to get the biggest news straight to your inbox