Nintendo: Time for an intervention?

The trend line isn't good, the forecast is bad, and the competition is ugly; what is Nintendo planning to do?

Whenever the market shifts, as ours does with such regularity, we come to inflection points. Opinions invariably divide on how those inflection points will pan out - it's the nature of disruption.

This week's quarterly financials from Nintendo, which highlighted missed sales targets for the Wii U and 3DS, have brought exactly such a situation into sharp focus. When a company as big as Nintendo, which has until so recently been held up as a paragon of adaptive success and market growth, stumbles, pundits and punters alike are quick to make a diagnosis.

We're no hive mind at GamesIndustry International, so we prefer to give you both sides of the argument whenever we can. To that end, we'll have two pieces about the impact of both the financial results and the sales figures revealed by Iwata, each arguing from a different perspective.

Below, we have an op-ed from our West Coast Editor, Steve Peterson, arguing that Nintendo needs to make some changes or risk serious damage. Tomorrow, regular columnist Rob Fahey will be putting his case for a different interpretation: that any doom sayers are over-reacting and that the publisher will ride out the storm quite happily. Of course, we expect to see you having your say in the comments threads, too.

The quarterly report from Nintendo was, once again, disappointing. Not only did the company miss its numbers, but Nintendo lowered its forecast for the fiscal year by a couple billion dollars. CEO Satoru Iwata apologized as he cut sales estimates for all of the company's consoles. This is becoming a regular quarterly ritual for Nintendo, and it's agonizing to watch. What's going on? Is this just a bad patch before a great surge in sales? Let's look at the overall picture.

Nintendo has known for years that Wii sales are declining, and the pace is accelerating. Nintendo's answer was the introduction of the Wii U, a new console that finally brings Nintendo to relative parity with the current generation of HD consoles. Many have argued that Nintendo should have done this a year or two earlier, before the Wii completely lost its ability to sell and to attract third-party development. Regardless, Nintendo finally introduced the Wii U, but with a relatively high price of $299 for the entry level (and most sales were of the $349 version).

As was expected, many fans rushed out to buy the Wii U; after all, it's a new console from Nintendo. Yet as many in the industry feared, Wii U sales have dried up since Christmas, and Nintendo just lowered its Wii U sales forecast for the year ending in March to 4 million consoles total, down from its previous forecast of 5.5 million units. That's a reduction of of over 25 percent. 3DS sales estimates were also cut, from 17.5 million units down to 15 million units, and DS sales were reduced from 2.5 million to 2.3 million.

"Nintendo's chance to attract third-party development dollars is rapidly vanishing along with the Wii U's sales momentum"

Steve Peterson

Nintendo is still planning on generating a profit this year, though the net income projected is only $154 million on total sales of $7.368 billion, which works out to about a two percent profit. Nintendo would be better off investing its money; that's a terrible rate of return. It's especially embarrassing when you look at the profits Japanese companies like Gree and DeNA are posting, which are hovering around the 45 percent level on sales of over $2 billion apiece. If you put Gree and DeNA's sales together the total is approaching Nintendo's; give the two companies another year or two and they will probably pass up Nintendo and never look back.

Clearly, for Nintendo to post a profit on this scale is not a sustainable business strategy; it's a way to avoid embarrassment, such as the massive $473 million loss of last year. With slower than expected sales of hardware and software, Nintendo has probably been cutting back on marketing expenditures. Certainly we didn't see a massive amount of TV commercials, nor other kinds of marketing efforts over the holiday season. Yes, it's good that the company has been keeping expenditures under control, but the trend line is not promising. Much of the gain Nintendo is looking at comes from the improvement in exchange rates, which is outside of anyone's control. As a business strategy, sitting around waiting for the macroeconomic environment to get better is not a winner.

Iwata-san took to video last week to apologize for delays in Wii U software, and to talk vaguely about great games coming in the (mostly unspecified) future. That's not going to revive sales of the Wii U; people are going to wait until the games they have to have actually appear before dropping $300+ on a Wii U and accessories. That's a rational decision, given that Nintendo may well reduce the Wii U price at some point, or software might be delayed, or some nifty new console might arrive from some other manufacturer. Why spend the money on a Wii U now if there aren't enough games, and a proven stream of exciting releases, to make your investment worthwhile?

The gaming environment is only going to get more competitive as time rolls on. Nintendo will be attacked on the high end, with new consoles from Sony and Microsoft, on the low end with Android consoles like Ouya and GameStick (and existing consoles with much lower price points), and on the undefended flanks by smartphones and tablets and free-to-play online games. Nintendo's chance to attract third-party development dollars is rapidly vanishing along with the Wii U's sales momentum.

Look no further than EA's earnings call yesterday, when EA CEO John Riccitiello basically said the Wii U was not a next-gen console, and not one the company is looking at to revitalize the game industry. The Wii U can expect weak support from publishers who are gearing up for new consoles from Sony and Microsoft. Sure, they may not sell all the that well, either, but at least it hasn't been proven that they are slow sellers. Sources in the industry indicate there are not many big titles being planned for the Wii U among major publishers, and this should not be a surprise

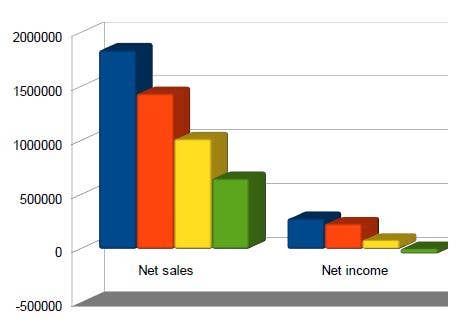

Nintendo's sales and earnings have been on a steady path since fiscal year 2009. The graph (in yen) shows the trend clearly; in FY2009 Nintendo's sales were over $20 billion; the next year $15.8 billion, then $11.2 billion, then $7.1 billion last year, and projected for this fiscal year (ending March 31) a slightly better $7.37 billion. Before the revision yesterday, Nintendo was projecting sales of $8.9 billion for the fiscal year.

The net income story is similarly grim: $3 billion in FY2009, then $2.5 billion, $858 million, then a loss of $473 million for FY2011. Now Nintendo is projecting for this coming year a profit of $154 million, or in the neighborhood of two percent. This is largely being achieved through an improvement in the exchange rate for the yen, and what looks like Nintendo reining in spending, particularly on marketing.

Nintendo's CEO took some time to explain the finanical results and the company's strategy going forward. "In the overseas markets, Nintendo 3DS has not yet solved its chicken-and-egg problem as a platform. To put it another way, we do not yet have a virtuous cycle where hardware sales and software sales drive one another. Because of this, our lineup lacks diversity, and as a result, Nintendo 3DS does not have as wide and diverse an appeal as Nintendo DS. As a consequence, software sales, which should ideally grow in proportion to hardware sales, did not grow as expected."

"With Wii U, we have taken a rather resolute stance in pricing it below its manufacturing cost, so we are not planning to perform a markdown"

Satoru Iwata

Notice that there's no mention of other options for mobile play, such as smartphones. The issue in Iwata's mind appears to be merely that Nintendo has to ship more of its software to the US and Europe.

Iwata turned his talk to the Wii U, explaining that it sold well initially, but then stopped. "However, since we were unable to incite enough excitement in society, we have failed to maintain its momentum after the turn of the year. In addition to this, because of some delays on the development side, we were unable to continuously supply software at the beginning of this calendar year. This has further upset our scenario for market penetration, for which momentum is the key."

Iwata attributes the problem to the complexity of the Wii U. "While it was pointed out that, unlike in the case of Wii, it was difficult to instantly understand the appeal of Wii U, those who purchased it, although there are issues to be addressed, have shown a certain degree of satisfaction with our product value, but since its value by nature is something that takes time to appreciate and hence cannot be spread amongst society instantly, we have yet to communicate its value to the wider public. To put it another way, we delivered Wii U to those consumers who we thought would be the first to buy it, but information has not successfully been passed on to those consumers who we think will be the next people to buy it. This must be one big factor with which Wii U could not maintain its momentum."

Or, you know, it could be a lack of compelling games for the Wii U. Or maybe it's the price? Why not reduce the price and see if that gooses sales; it worked for the 3DS, right? No way, says Iwata. "With Wii U, we have taken a rather resolute stance in pricing it below its manufacturing cost, so we are not planning to perform a markdown. I would like to make this point absolutely clear. We are putting our lessons from Nintendo 3DS to good use, as I have already publicly stated. However, given that it has now become clear that we have not yet fully communicated the value of our product, we will try to do so before the software lineup is enhanced and at the same time work to enrich the software lineup which could make consumers understand the appeal of Wii U."

In other words, don't look for any price drops soon. Nintendo will first try to get some good games out there, and perhaps spend some money on marketing trying to explain why the Wii U is a great console to buy, and pay no attention to those shiny new consoles coming from other manufacturers soon. Or those tablets. Or those free-to-play games on your computer. Anyway, maybe if Wii U sales are still slow after some new games and some marketing, maybe then there will be a price drop. Maybe.

Iwata again: "Regarding the Wii U, it is now clear that many consumers have not understood its product value. We hope to change the situation from now and make a drastic improvement before the latter half of the year starts. The Wii U is a game console you can enjoy most with the Internet connection and the current Internet-Connection ratio is 74 per cent, which means that almost three of four consoles have been online already. This is clearly higher than the previous hardware system we released. We will continue to inform our consumers about the advantages of using the Wii U consoles online to further increase this ratio."

Only 74 percent have connected their Wii U online? Add that to the list of reasons Nintendo is struggling to make money; it hasn't figured out that selling things online to game players is a great business opportunity.

Iwata has a clear plan for the future, though: "It is our must-do for the next fiscal year to revive the momentum of our overseas business, expand the market by exploiting the potential of our products, and therefore retrieve 'Nintendo-like' profits. For the next fiscal year, with the premise of the current trend of currency exchange rates, the management aims to earn 100 billion yen or more of operating profit by reviving the momentum of our overseas operations."

That's a laudable goal, but it's hard to see how Nintendo's current strategy will ever get it back to the level of $10 billion in sales, let alone $20 billion. The company's strategy apparently takes no notice of current or impending competition. It seems logical that the arrival of new consoles from Sony and Microsoft at pricing in the neighborhood of the Wii U might make it harder to sell the Wii U. Nintendo has a very short window of time in which to get the Wii U's pricing ready for the competition (that is, make sure it's substantially cheaper), ship some really great games, and make sure there's a consistent marketing message explaining the Wii U's benefits.

At the same time, Nintendo has to keep the 3DS going in the face of ever-increasing tablet and smartphone competition. Games on tablets, at least, are getting increasingly sophisticated in design and execution. Already the horsepower of smartphons and tablets are catching up to and passing the 3DS. Nintendo's going to have a more difficult time selling the 3DS, as the reduced sales forecast indicates.

"It's time for the three-step program: 'Step 1: Get a clue. Step 2: Get a grip. Step 3: Get a life.'"

Steve Peterson

Is Nintendo doomed? Not at all; as EA's CEO Riccitiello said, "Never count Nintendo out." Nintendo has over $10 billion dollars in cash and some of the very best IP in the game business. Nintendo has adjusted itself to make a profit even at a sales level that's less than half of what it was a few years ago, and with its massive bank account it could continue for many, many years on ever-dwindling sales.

Or Nintendo could take some bold actions. The company could buy game developers, drastically reduce pricing on hardware to establish a broad installed base, commission some of the top third-party games to include special features for Nintendo hardware (or even just to appear on Nintendo hardware). Nintendo could start spending more, perhaps a lot more, on marketing; even on creating other media based on Nintendo IP in order to generate interest in the games (animated TV shows, for instance).

Instead, the company is plodding along, clinging to its cash and making no sudden moves, hoping that for some reason people will suddenly decide to start buying Nintendo products again. The possibility of even more radical ideas, like putting Nintendo characters on smartphones or creating a Pokemon version of Skylanders, seem completely beyond consideration.

If Nintendo were a person, friends would be calling for an intervention. Get Nintendo to recognize the real problems in front of it; acknowledge the company's strengths, and get it to understand that business as usual won't work when the market is anything but usual. It's time for the three-step program that Warren Spector once described to me: "Step 1: Get a clue. Step 2: Get a grip. Step 3: Get a life." Nintendo needs to get busy on Step 1, because the market is moving faster than ever.