Stock Ticker: Why EA's Market Valuation Has Crashed

EA's market valuation is down 50 per cent since November. What's gone wrong?

Two stock market stories have captured the attention of the games industry in recent months - the weak post-IPO performance of Zynga, and the dramatic bellyflop of THQ, whose shares have lost 80 per cent of their value over the past 12 months. Against that backdrop, few people seem to have noticed what's happening to Electronic Arts' valuation - yet a quick glance at EA's performance reveals a worrying situation and suggests a tough time ahead for the company which used to be the industry's biggest third-party publisher.

"This fluctuation represents billions of dollars moving out of the company's valuation"

Electronic Arts' stock has lost almost 40 per cent of its value since the start of this calendar year - and in fact, since the middle of last holiday season (around November 2011) the company's stock has been in a steady decline which has now wiped close to 50 per cent off EA's valuation. It's not a decline as sharp as THQ's, but it represents a much larger loss of value - THQ's market capitalisation is only around $50 million, whereas even after this enormous loss of value, EA is still capitalised at around $4 billion.

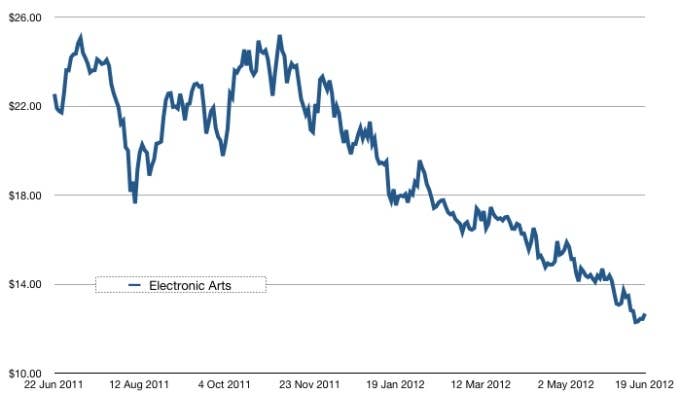

To visualise EA's share price decline, let's look first at a simple graph of its performance over the past 12 months.

The decline I'm talking about is clearly visible - starting last November and carrying on almost uninterrupted right up to this week. From top to bottom, that slope covers 50 per cent of EA's valuation, from a high of just over $25 in November down to a low of $12.29, recorded just last week. While it's not unusual for small companies' share prices to fluctuate this strongly during times of trouble, EA is not a small company. This fluctuation represents billions of dollars moving out of the company's valuation, and the fact that it's a trend which has persisted for six months suggests that investors are genuinely concerned about EA, rather than simply being spooked by rumours or speculation in the short-term.

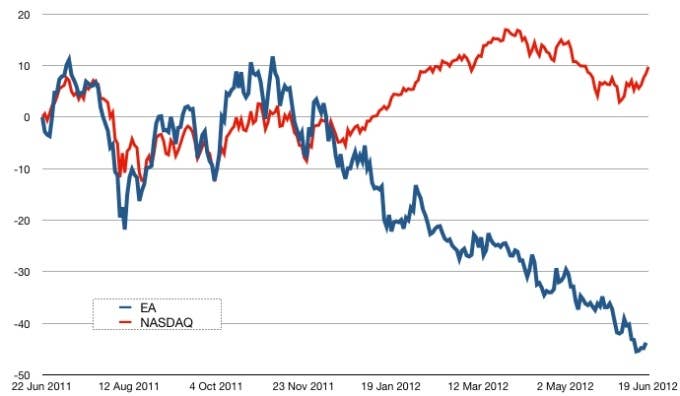

To get a clearer picture of where EA stands and what the problem might be, it's important to isolate the company's performance from wider economic factors. The most straightforward way to do this is to graph the firm's share price against the performance of the NASDAQ, the New York based stock exchange which lists most of America's high-tech companies. This next graph shows the NASDAQ's overall performance in red, alongside EA's stock in blue.

This graph is useful, because it pinpoints the start of the problem - and also reveals that EA's performance is even weaker than it seems at first glance. As you can see, EA's share price pretty much tracked the performance of the NASDAQ up until the end of last November - meaning that market sentiment around the firm was basically neutral, with investors considering it no stronger or weaker than its peers on the stock market. Then, while the NASDAQ itself saw fairly solid gains in the first half of 2012, EA went into free-fall. To the 50 per cent loss of value in the stock itself, we now have to tack on around 10 per cent of additional losses - since EA's stock should reasonably be expected to be 10 per cent higher, if it had only managed to perform on the same level as its peers in the NASDAQ.

Something has gone terribly wrong for EA, at least in the eyes of stock market investors. There are several plausible explanations for this - each of which is likely to be true to a certain degree, since it's unlikely that any one factor alone is responsible for driving the price down so far.

"For SWTOR to fail makes Riccitiello's entire strategy look dodgy to investors who were already deeply concerned by the slow pace of progress"

Firstly, there's Star Wars: The Old Republic. EA's stock price went into decline after The Old Republic's launch, and hasn't recovered yet - and that timing is unlikely to be a coincidence. Expectations among investors for SWTOR were extremely high, given the game's much-publicised high development costs (which probably make it the most expensive game project ever), the strength of the Star Wars license, the track record of developer Bioware and, crucially, the tantalising possibility of building an ongoing MMO revenue stream for EA which would match the one enjoyed by rival Activision Blizzard from World of Warcraft. While it would be unfair to characterise SWTOR as a complete failure, it has certainly not been a success on the level which EA or its investors would have wanted. The game has lost 400,000 subscribers since February, and it seems inevitable that the company will be forced into an embarrassing (but probably commercially sensible) transition to a free-to-play model sooner rather than later.

For many investors, the disappointing performance of SWTOR is almost certainly seen as the "final straw" in terms of the second factor in this decline - John Riccitiello's leadership of EA. Riccitiello has been CEO since 2007, and arrived to the job promising to turn the company around - outlining a transformation plan which would see EA focusing on quality, controlling costs, embracing digital business models and improving the company's tarnished reputation. In some respects, his successes are undeniable. EA's digital business is booming compared to most of its commercial rivals, and while the company still attracts brickbats from vocal fans on the internet on a regular basis, titles like Mass Effect, Dead Space and Battlefield have also earned it a reputation for creating high-quality "core" titles.

In other respects, however, Riccitiello's transformation of EA is clearly struggling - not least in terms of timescales. When he arrived in 2007, it was anticipated that the process he wanted to bring the company through would take three years. In mid-2012, there's still no end in sight. It's unsurprising that the stock market would be extremely wary of a business which, to quote another industry watcher, is presently in year five of a three-year transformation project that's actually going to take seven years. SWTOR was almost certainly being used by many investors as a test of Riccitiello's strategy. It's a hugely expensive title, created by a studio with a reputation for quality (which Riccitiello himself added to the EA group as one of his first actions on becoming CEO), and focused strongly on digital business objectives, not least of which was being the flagship title for Origin, EA's Steam competitor. For SWTOR to fail makes Riccitiello's entire strategy look dodgy to investors who were already deeply concerned by the slow pace of progress.

"Investors would like to see some kind of exit for EA, which means that they're not confident in the firm's future"

Not convinced that investors have lost faith? Look how quick they were to spread the frankly barmy rumour that Japanese-Korean free-to-play gaming firm Nexon was going to buy EA - an incredibly unlikely proposition from the outset, yet one which was widely reported and discussed both within the games business and within the investment community. That tells you something important; firstly, it illustrates how far EA has fallen within the market (despite having a healthy slate of titles and pretty solid financials), and secondly, it tells you that investors are very, very keen for something like that to happen. They'd like to see some kind of exit for EA, which means that they're not confident in the firm's future.

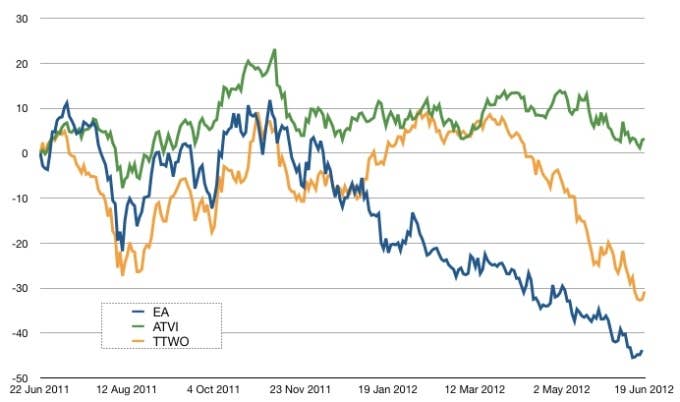

Although the overriding factors in EA's valuation collapse are internal, it's important to look at wider factors within the industry as well - because the reality is that this is not a situation that's confined to EA. Many games publishers face a tough transition, not merely to next-gen console hardware next year (which is tough enough in itself), but also to a world of new business models and new competitors. Several of them probably won't make it unscathed, and the stock market knows it. Here's a graph showing EA alongside its two main US competitors, Activision Blizzard and Take Two.

As you can see, EA is underperforming its rivals by a pretty significant margin - but look at Take Two's numbers by comparison. It starts declining later in the day than EA, only seriously dropping off in March of this year, but the decline itself is even steeper than EA's. Since March, Take Two has lost over 30 per cent of its value, which strongly suggests that many of the same concerns which are depressing investor confidence in Electronic Arts are also being applied to Take Two.

"The games industry's most bankable company in the USA right now is only just managing to keep up with its tech industry peers, while the other top two publishers are rapidly spiralling down the plughole"

The outlier here is Activision Blizzard, which is keeping its head - and its valuation - well above water. Since EA's fall from grace, Activision Blizzard is absolutely dominant in terms of market capitalisation - it's now worth over three times more than EA according to the stock market, which suggests a much higher degree of confidence in Activision than in any of its rivals.

That confidence is based on a few factors. First, there's Blizzard - a company which has demonstrated an unmatched ability to break away from the hit-driven structure of the games business and instead create games that keep paying for themselves years after launch. The steady revenue stream from World of Warcraft may be slowly dropping off, but it's still the single most valuable product in the games industry, generating strong revenues month after month and making Activision Blizzard vastly more bankable than any other company in this sector. Secondly, there's Call of Duty - a franchise which has reliably produced the biggest-selling games of the year, every year for the past half-decade. That goose won't keep on laying golden eggs forever - in fact, it's probably already in decline - but it's another factor which investors see as reliable and bankable, at least for now.

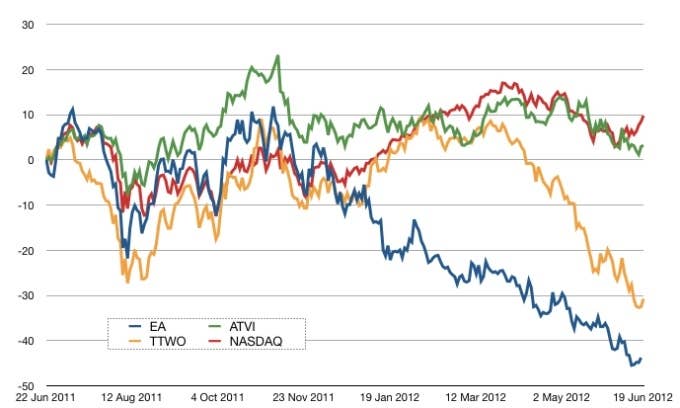

Even so, it's not all roses in the garden - even for Activision Blizzard. This final graph adds the NASDAQ composite to the picture, showing how the big three US publishers match up against their peers on the stock market.

In this graph, the problems facing EA and Take Two are even more starkly revealed, as both of them are veering sharply away from the red line (which you can think of as a kind of average of the performance of American tech companies). Activision Blizzard, meanwhile, is just about managing to hug the line - slightly underperforming it in the past few months, if anything.

In short, the games industry's most bankable company in the USA right now is only just managing to keep up with its tech industry peers, while the other top two publishers are rapidly spiralling down the plughole. The overall picture is not encouraging. Investors are clearly deeply worried about the games industry's biggest companies - they're cautious on Activision Blizzard, and downright negative on EA and Take Two. EA needs to focus on convincing the markets that Riccitiello's plan is going to work out, of course, but it's also clear that there's a wider challenge here for the entire games industry. The next transition, which has already started, is going to be the toughest one the industry has ever faced - the stock market knows it, and until the industry can show itself to be ready to cope with that transition, investors are going to steer well clear of videogame-related stocks.